Matched Betting News

A slight step off our usual beaten path here but I thought it might be interesting to discuss some of the latest updates in the world of matched betting during what seems to be a particularly quiet month for offers.

Affordability checks rumoured to be canned

Last year the Gambling Commission opened a consultation seeking consumer and company views on proposed changes within the gambling industry. They went through a similar exercise a couple of years ago, one of the biggest results of which was the removal of massive bet options on the instore terminals.

Another outcome of that first consultation was a requirement for bookies to conduct ID checks at time of deposit and not use further ID checks as a means to withhold withdrawals. Obviously we all know the bookies took no notice of this and the Gambling Commission has been completely toothless in enforcing it.. but the thought was there at least.

In their continued crusade to protect consumers from the dangers of gambling, the Gambling Commission then sought opinions of the use of affordability checks and potentially extending these checks to make them far more rigid. One such proposal was for every bookie to have a monthly loss-limit beyond which you would need to prove affordability to sustain those losses. Another proposal was a blanked affordability check for anyone gambling over !00 in a month. Clearly for us matched bettors this would be disastrous as most of what we do involves churning large amounts of money through the bookies & exchanges without them being aware of it.

Fortunately it now looks like the Gambling Commission is due to shelve the affordability check proposals due to the responses received from the recent consultation. The Telegraph reports that:

The enforcement of applied affordability checks on all UK gamblers wagering over £100 a month has been submitted to the review as an industry safer gambling and consumer protection measure – which has been received as one of the review’s most divisive issues between participating stakeholders.

This morning, The Telegraph reported that enhanced affordability check requirements will either be ‘watered down or shelved completely’.

Which is excellent news for us and goes to show that it is always worth contributing to these gambling related consultations.

Team Profit Sale

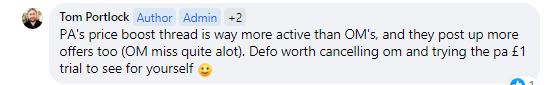

Eagle-eyed members of the Team Profit facebook group noticed a couple of months ago that the group had apparently switched allegiances from their beloved Oddsmonkey and onto Profit Accumulator. No longer were new members having the benefits of Oddsmonkey rammed down their throats and instead it was Profit Accumulator they should be heading to.

Team Profit staff also starting making comparisons of Profit Accumulator to Oddsmonkey with PA obviously coming out on top every time now.

When queried on this, staff gave some flimsy reference to the Covid pandemic and then switched back to their “it’s better” narrative

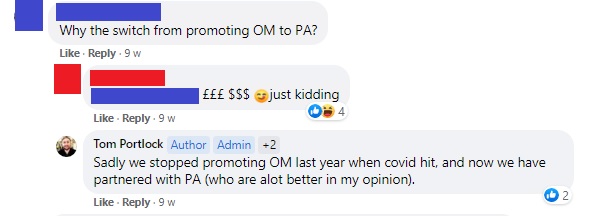

It was around this time that the original Oddsmonkey review page on the Team Profit website was removed, and all affiliate links switched to point to Profit Accumulator instead.

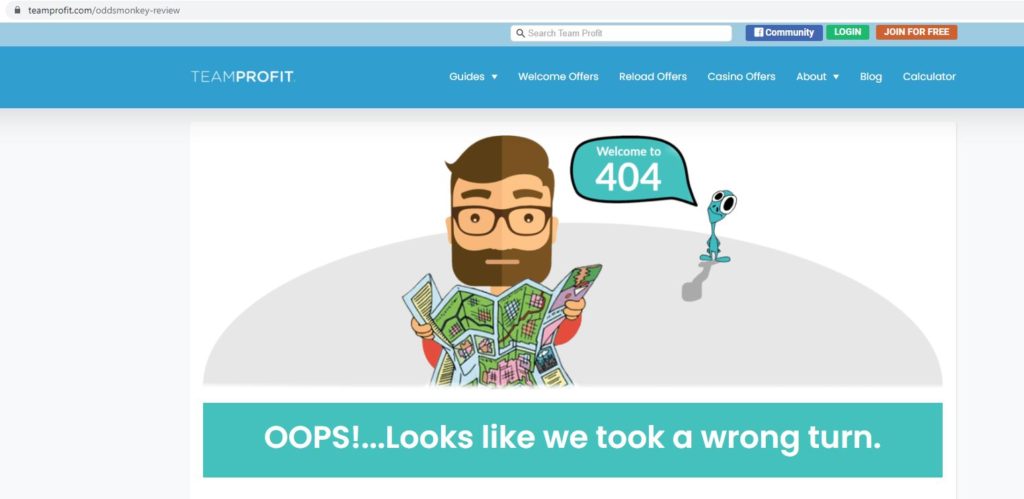

Fortunately the original page remains on the Internet Wayback Machine:

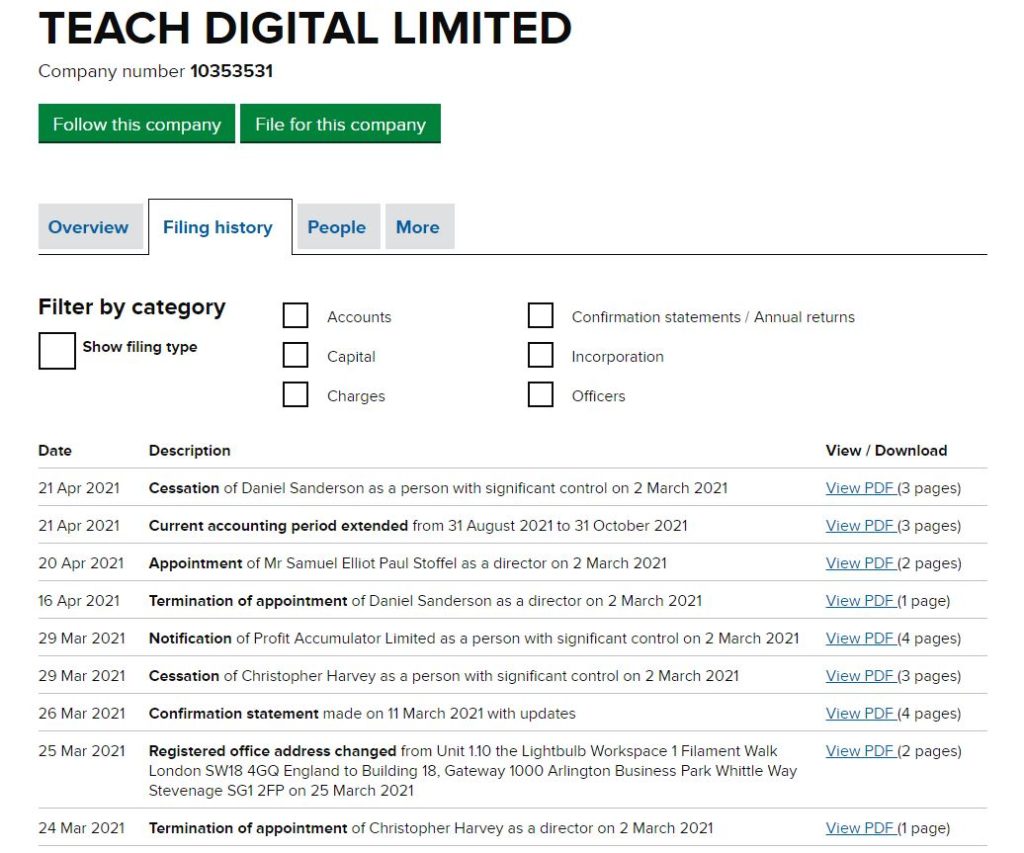

Very strange that a group the size of Team Profit would suddenly switch from promoting Oddsmonkey so heavily to their main direct rival, while also trying to scrub any previous reference of the Oddsmonkey affiliation. I did some digging into this and discovered that Teach Digital Ltd (Team Profit’s company name) made some huge changes back in March. One of the directors resigned and apparently sold all his shares, the company registered office also moved. Then in April the other company director resigned and 100% of the company’s shares were transferred to Profit Accumulator Ltd with Samuel Stoffel appointed as the new director of Teach Digital Ltd.

So that explains it; Team Profit had been bought by Profit Accumulator. I’m not so sure why all the secrecy, and it seems Team Profit are banning anyone who mentions the sale from their Facebook group so be careful discussing it on there if you are a member.

Football Index’s first administrator report released

Following the collapse of Football Index in March 2021, administrators were bought in to access the company’s finances with a view to try to recover some of the millions owed to customers.

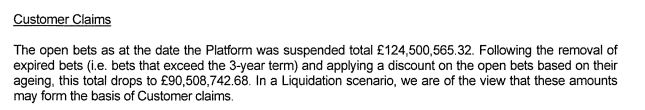

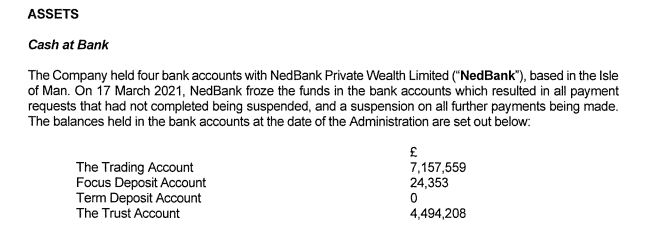

A couple of months on and we have now received the first of their reports which show the company as having had a horrifying £124million worth of open bets (shares) of which £90million would have been owed to customers.

In comparison the company’s accounts showed a combined amount of just £11million from which assets could be recovered against.

What’s clear is the company could never have afforded to even payout had everyone sold their shares.. let alone maintain any level of sustained dividends. This looks like a clear case of a Ponzi Scheme and hopefully the directors will be held to account.

2 thoughts on “Matched Betting News”

Hi Guy. Interesting article. I had been wondering why the reload offers provided on team profit had been reduced. Now I know why.

Yup, exactly. It’s interesting that they made the sale because presumably they had a nice stable affiliate income from Oddsmonkey which I’m guessing they’re now not paying to PA. Perhaps the TP owners decided they had already reached peak membership numbers and so better to jump ship now with a lump sum? I expect the figure paid will be apparent in PA’s next set of financial records so I’ll update once we know that.